Banking

An issue can be closed to trigger revenue recognition in the system. When this configuration is set to No, an issue is considered closed on its reporting date. Enabling the ability to manually trigger the close of an issue allows a user to select a close date for any past issues.

You can prevent changes to financial information if the GL period is closed in the system. This means you won’t be able to edit or create transactions with items dated in a closed GL period. This will affect creating invoices, editing invoices, deleting invoices, deleting line items on an invoice, editing line items on an invoice, creating credit memos, and making or voiding payments.

Your business Bank address for receiving payment by ACH

Your business address for receiving payment by Check

Your business address for trade/barter transactions.

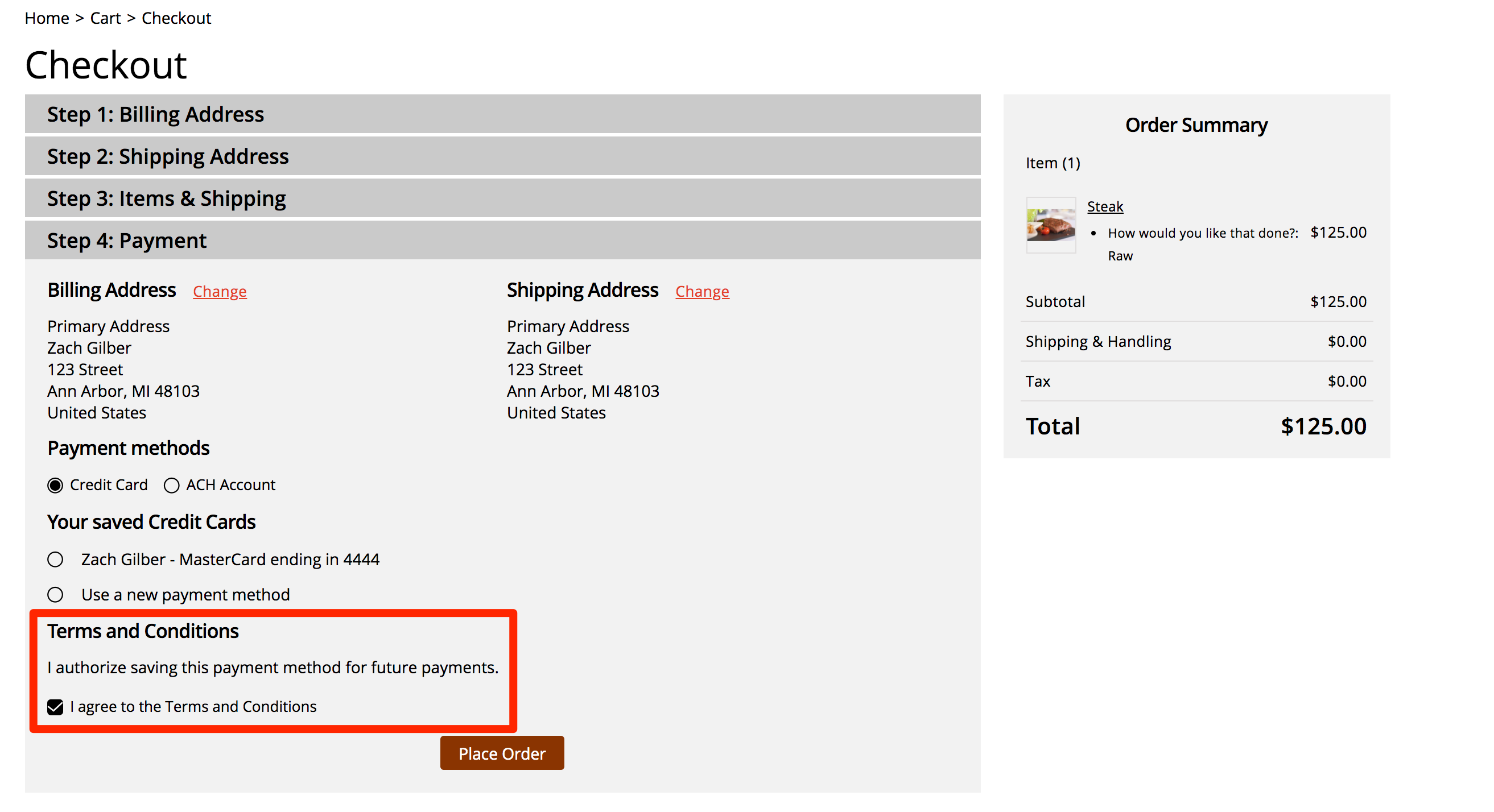

Payment Terms for customer one-time electronic payments. Your customer will see your terms when making a payment on the system store front. The terms display when customers enter their form of payment.

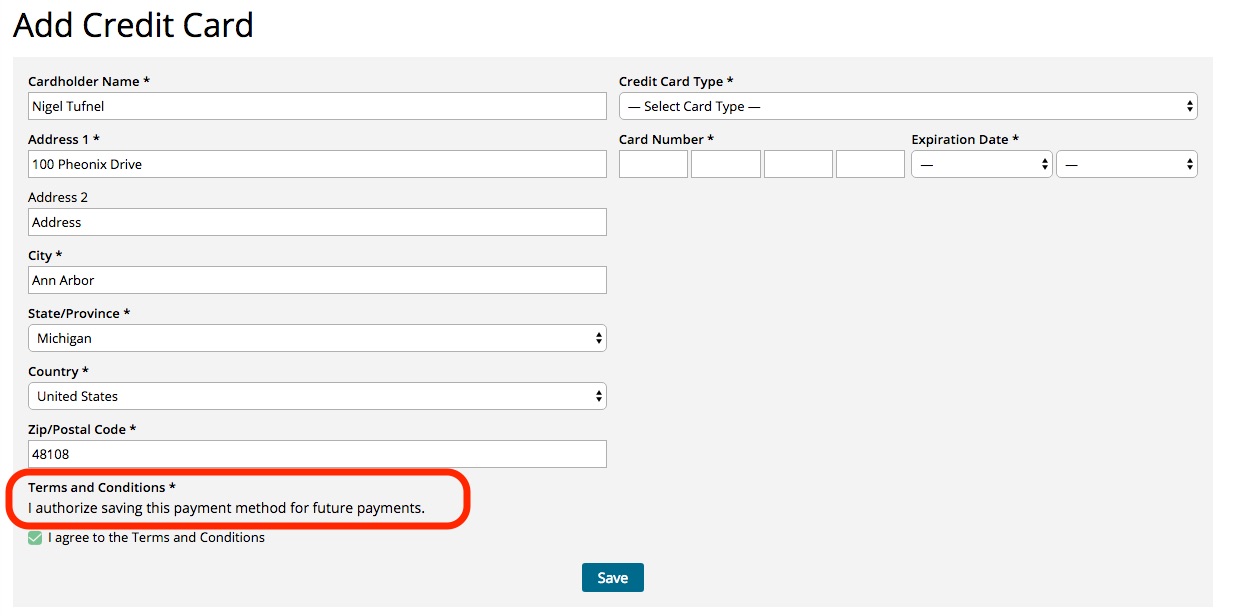

Payment Terms for customer saving a payment method in client center. The customer will see the terms when adding a payment method to their account or approving an order.

You have three options for how you want to display foreign currencies on your contract, invoice, and statement templates.

No FX processing and always show in Base Currency: The system will always show your base currency symbol, e.g., USD, on all templates even if your customer using CAD, AUD, EUR, or GBP.

No FX processing and show relevant Currency: The system will show the customer their currency symbol. For example, if your base currency is USD but the customer’s currency is EUR, their contracts and invoices will show € instead of $. The system will not do any conversions. The exchange rate is determined when the payment is processed.

Enable FX processing and show relevant Currency: The system will show the customer their currency symbol and use sold date or invoice date to determine the current exchange rate.

You can have only one currency set up for your account: USD, AUD, CAD, EUR, or GBP. But while your account can have a single currency for processing payments, your customer can have their currency setting. By default, your customer will use your currency. All payments settle based on your currency, but you can show your customers how much in their currency they owe you on contract and invoice templates based on the exchange rate.

The exchange rate is based on the contract sold date and the invoice date. My account is set up to USD currency. All of my customer’s payments will convert to USD at the time the payment is settled. But if the company has a different currency setting, their contract, invoice, and statement templates will reflect how much they owe you in their currency.

You can change their currency in the company details > billing info section. Here is an order for USD 1000. Spinal Tap is based out of England, so they operate in GBP. When I generate their order, they will see how many pounds they owe me.

But let’s say they moved into the European Union. I update their currency, and the contract will now reflect how many Euros they owe me to pay me for the same $1,000 ad. Spinal tap owes me more Euros than Pounds, but I still get my USD 1,000.

The exchange rate is based on the sold date of the order. Their invoice will also convert the USD 1,000 owed to their currency so that the invoice may appear different than the original contract, but in the end, they still owe me the same amount. You will always receive the full $1,000 payment amount, but the amount the customer pays in their currency will depend on the date their payment settles with the processor.