Company Payment Term Discount

The Company Payment Term Discount allows for a customer to receive a discount on their invoice if they pay the invoice in full within a set number of days after the invoice date. The discount settings are applied on each company record, which means the discounts can vary based on customer. Every invoice for that customer will have the discount applied, as long as it fits the discount’s setting

How to Set Up the Discount

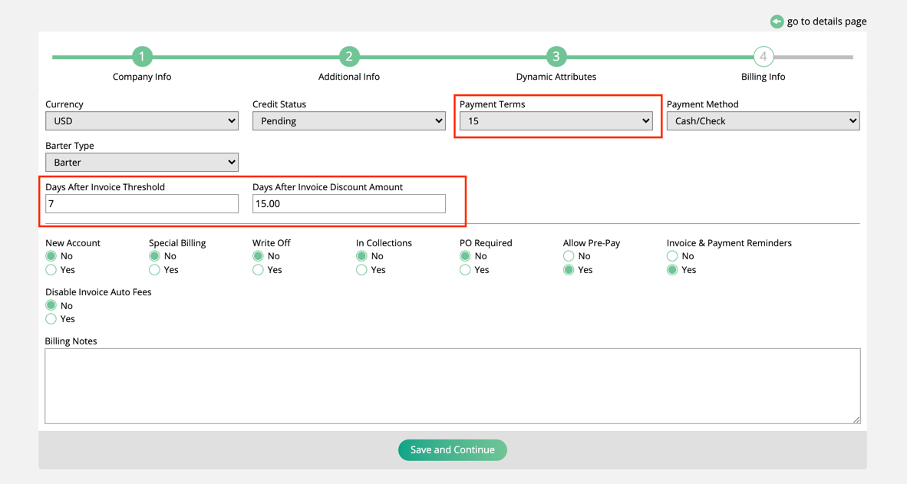

To set up a Company Payment Term Discount, navigate to a company in your system, and edit the company. You will need to go to Step 4 – Billing Info to set up the discount configurations. On the Billing Info edit page, there are three relevant fields for the discount.

Payment Terms: The payment terms of the company are helpful when deciding the ‘Days After Invoice Threshold’. For example, if the customer’s payment terms are Net 15 days, then you probably want to set your discount threshold to be less than 15 days. If over 15 days, then your customer can receive a discount on their invoice even though the invoice is overdue.

Days After Invoice Threshold: The number of days after the customer invoice date that a payment must be received by to get the discount.

Note

The discount does not take into account the Invoice Due Date, but rather the Invoice Date, to calculate the number of days the discount is valid for. For example, if you have an Invoice Date of 2/1, and an Invoice Due Date of 2/16, and the Days After Invoice Threshold is set to 10 days, then the discount will be valid until 2/11.

Days After Invoice Discount Amount: The discount percent that would be applied to the invoice based on the amount of the invoice. Enter a value between 1 and 100 here.

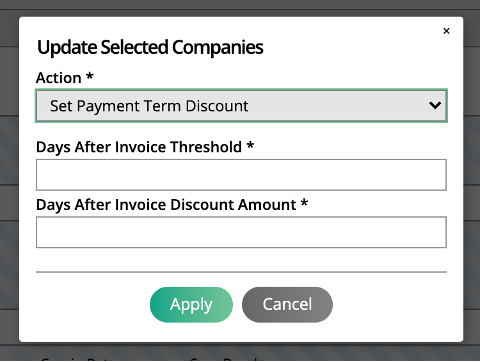

You can also bulk update the Company Payment Term Discount on multiple companies by going to the Company Search page.

In the search results, use the check boxes to select all of the company records you want to update, and then click ‘Update Selected Companies’.

In the popup, choose the action ‘Set Payment Term Discount’. You can then enter values for the ‘Days After Invoice Threshold’, and ‘Days After Invoice Discount Amount’ fields. The values entered here will apply to all of the selected companies.

Note

Any companies that did not already have values entered in the discount fields will have the new settings added, and any companies that did have discount threshold and percent amounts already entered will be updated to reflect the new configurations.

Applying the Discount

Once the discount is set up on a company’s record, there is nothing further you need to do to apply the discount to the invoice. The discount amount will automatically be applied to the invoice as long as it is paid in full (including any barter and tax amounts) within the Day Threshold.

Note

If this type of discount is used, when the payment is applied to the invoice, a credit memo will be automatically created by the system for the discount amount, in order to properly close the invoice.

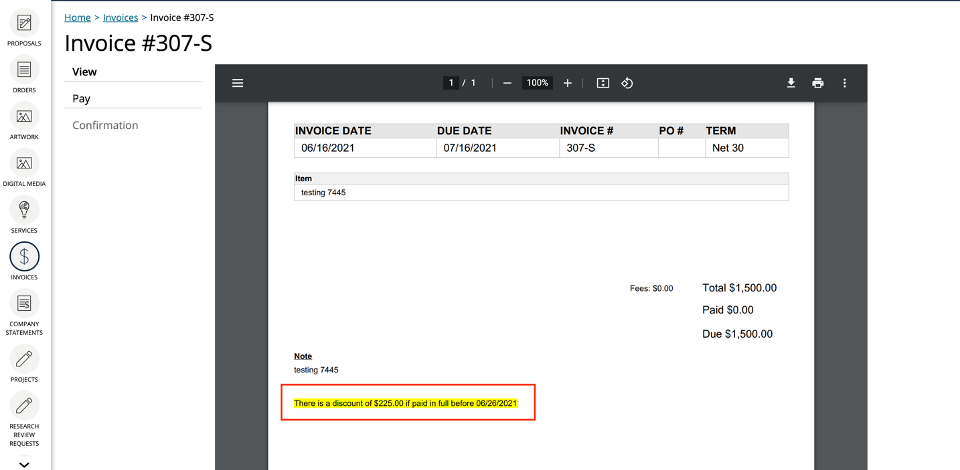

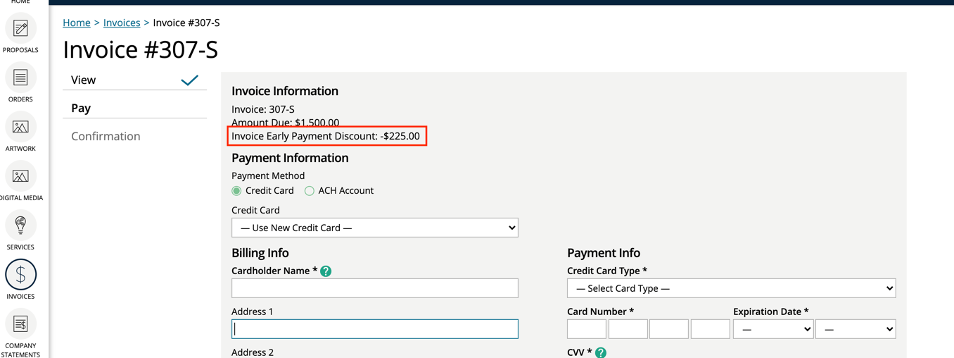

In the Client Center, the discount will be displayed in a couple of locations. On the invoice PDF, there will be a note showing the discount amount and when the invoice must be paid in order to qualify for the discount. Additionally, when the customer goes to pay the invoice, there will be a field showing the Invoice Early Payment Discount Amount, and the Payment Amount at the bottom of the page will also be updated to reflect the discount amount.

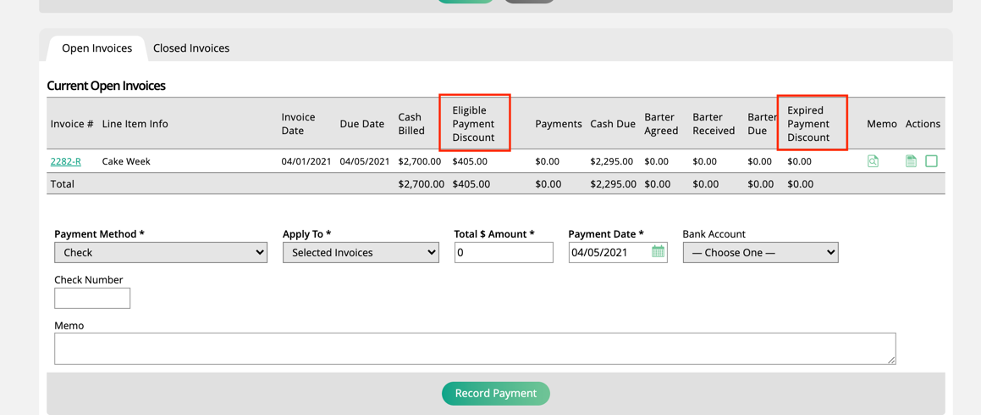

If paying an invoice from within the system, the discount amounts will be reflected on the Add Payments page. There is an Eligible Payment Discount column, and an Expired Payment Discount column.

Any invoices that are within the threshold to receive the Company Payment Term Discount will show the discount amount in the Eligible Payment Discount column.

If there are values showing up under the Expired Payment Discount column, that means there was a Company Payment Term discount available, but the invoice is now past the Day Threshold to qualify for that discount.

The Cash Due column will reflect the invoice total, minus any relevant discount.

Updated 4/27/2023

Updated 10/7/2022