QuickBooks Online Payables Exports

Vendor, approved Vendor Invoices, and Payments can export directly over to QBO. You must sync your QBO account the System and select the QuickBooks file format for exports. You can use the same exports files to manually import data into QuickBooks Desktop by using a 3rd party tool.

In order to start exporting data from the System to QBO, you must have QBO connected and enabled the payables export files. Go to Settings > System Configurations > Data > Exports and set Vendors, AP Invoices, and AP Payments to QuickBooks. Now that your files are set, you can start exporting Vendors over to QBO. The Vendor Overview page has the option to mark a Vendor Information as exportable. Set this to No if you never want to export a Vendor to QBO.

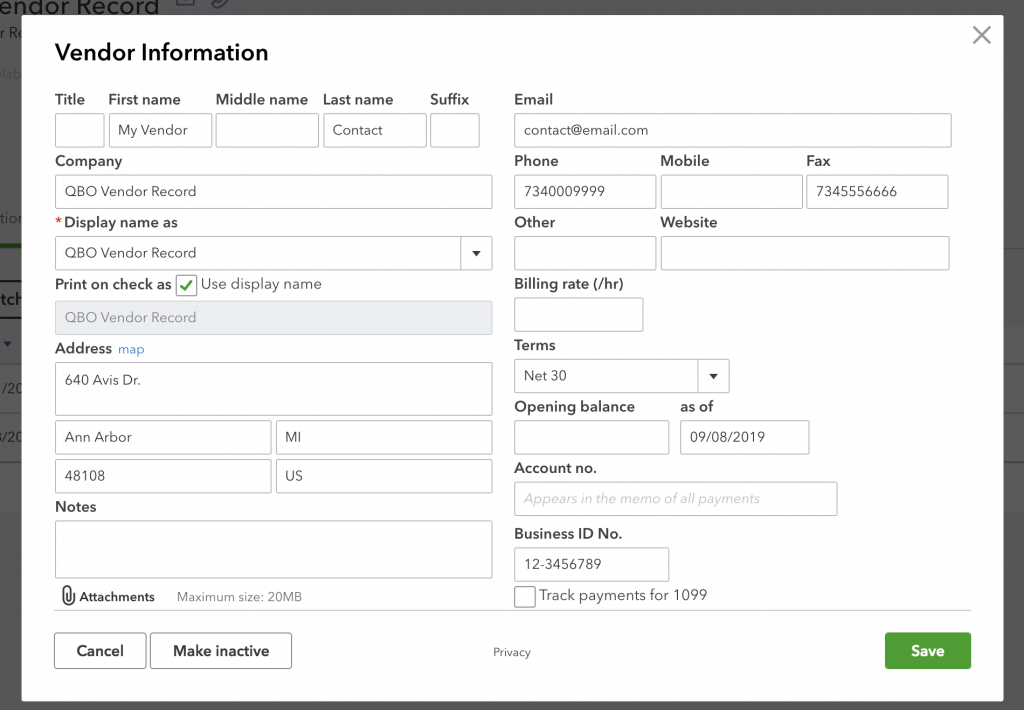

You need to mark a Vendor to export if you want to add or update the record in QBO. Vendor Contact information can go over to QBO as well. The system will use information from the first Vendor Contact added to a Vendor Record to add into QBO. When the export runs either automatically or manually, the system will create or modify a record in QBO.

The system will export the following information:

Vendor Name: Becomes QBO Company Name.

First Name and Last Name: will use the first vendor contact added to the Vendor.

Display Name: Vendor Name

Address: Uses the Vendor Address information.

Email: will use email of the first vendor contact added to the

Vendor.Phone: Vendor Phone

Fax: Vendor Fax.

Terms: The payment terms associated with the Vendor. EIN/Tax ID: will export over to the Business ID No. in Quickbooks.

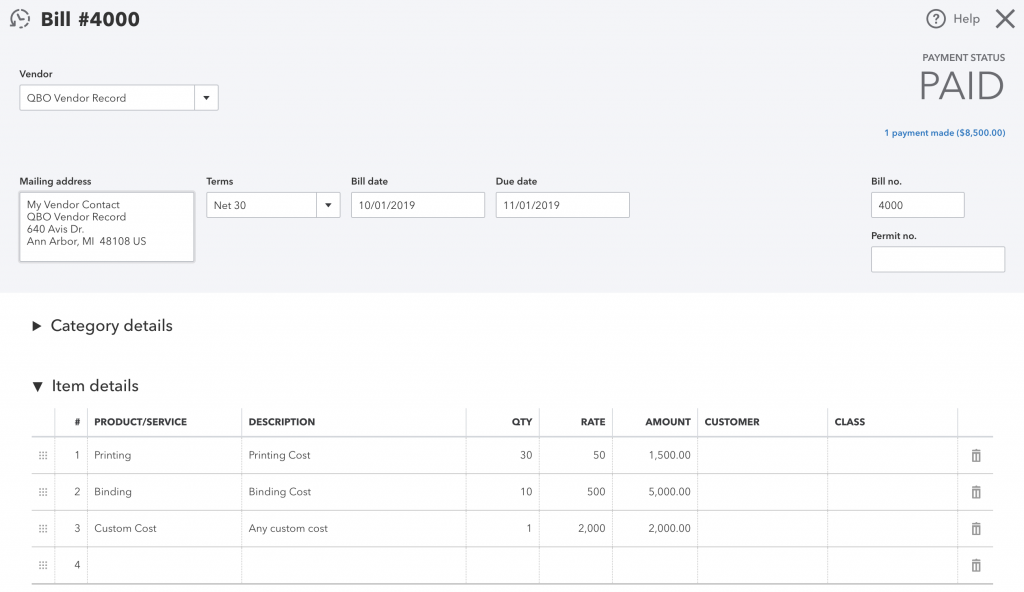

Now that you have Vendor Record in QBO, you can start exporting AP Invoices. The system will export approved Vendor Invoices over to QBO as a Bill. Once an AP invoice is Financed Approved, it will get set to export to QBO. Only invoices that are set to To Be Paid and marked for export will go over into QBO. You can override the export if needed.

The system will export the following information:

Vendor Name

Invoice Number: Becomes Bill number in QBO.

Address: Mailing address in QBO

Terms: Uses the Vendor’s Terms.

Bill Date: Uses the Invoice Date added by the Vendor.

Due Date: Uses the Invoice Due Date added by the Vendor.

Item: The item name will go over to QBO and create or associate with a QBO product/service.

Description: Uses the item description added to the purchase order.

QTY: The QTY of the item from the vendor Invoice.

Amount: The amount of the item from the vendor invoice.

Rate: The rate of the item based on the QTY entered and the Amount.

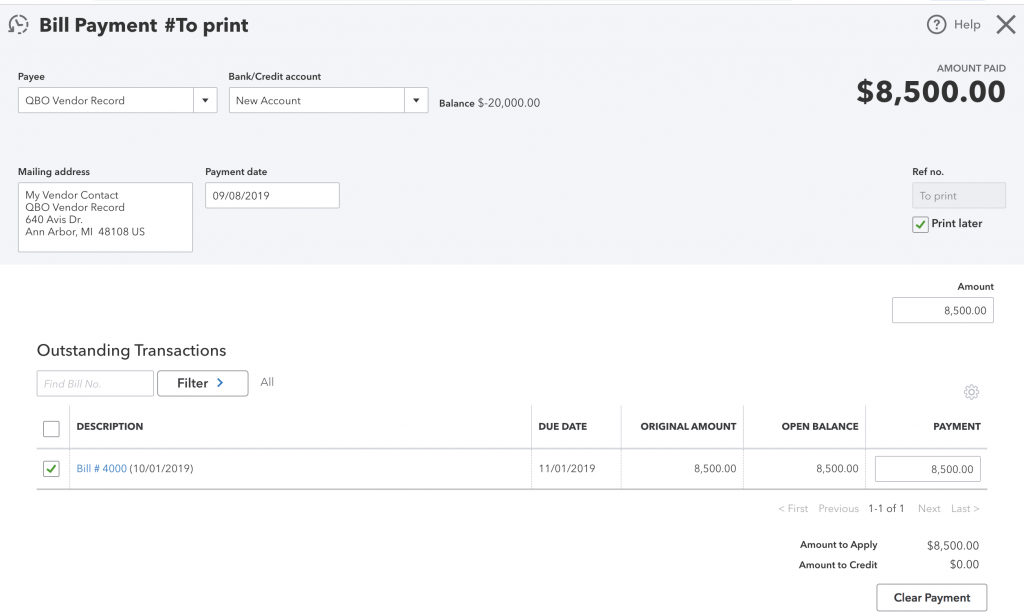

With a Bill now in QBO, you can record a payment to the AP invoice in the system and export the record to QBO. Make sure you have a payment account set up in the system that matches a Bank/Credit account in QBO. Select the payment account and the transaction number for the payment.

The system will export the following information:

Account: will go to a Bank/Credit account in QBO.

Amount: pays the full amount of the Bill in QBO.

Payment Date: The date the payment is recorded will go over to QBO as the payment date.