How Revenue is Recognized by Product

Print advertisements are recognized based on the reporting date of the issue. If an ad is on a past issue date, the revenue can be recognized. If the ad is on a future issue, the revenue must be deferred. You can add more control of recognizing revenue by closing your issues instead of relying on the reporting date.

To see the process of recognition print ad revenue we will go through an order with ads. The order has an ad in two past issues and two future issues: 2 months ago, 1 month ago, next month, and 2 months.

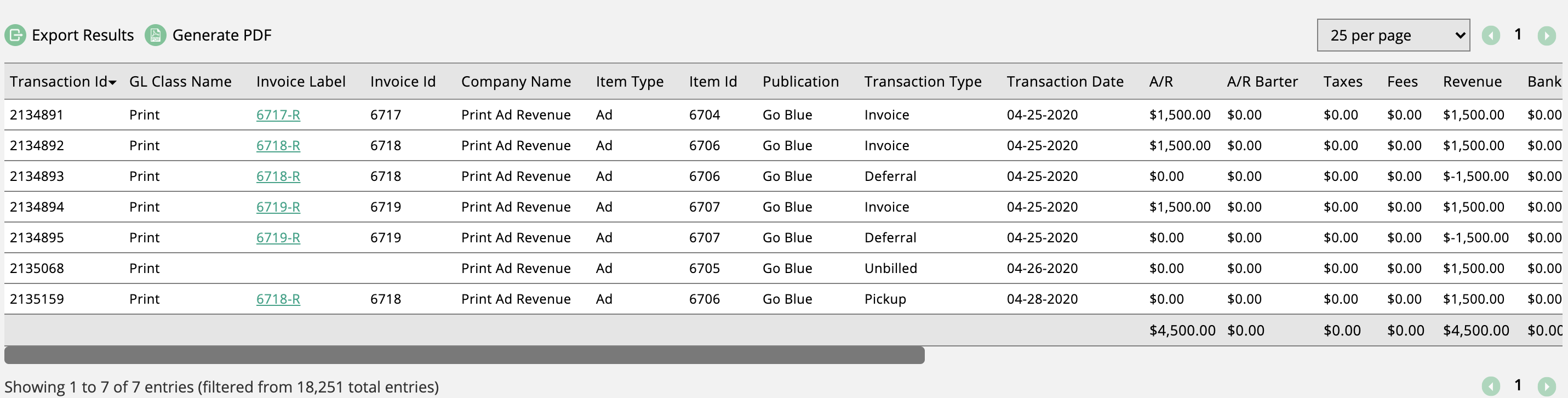

The issue from 2 months ago is in the past and the ad has been invoiced. Because the item was in the past at the time of recognizing, the system will recognize the revenue immediately.

The issue from 1 month ago wasn't invoiced right away. The ad was on a past issue and not invoiced, so the item started as an un-billed receivable.

The item next month was invoiced so there is in increased in deferred revenue, so it will be recognized soon.

The issue 2 months in the future wasn't invoiced, so it is also deferred but won't be recognized for awhile.

The un-billed item account will balance to the revenue account the day after it is invoiced. You will have record of all the transactions for your history.

The next month item will be picked-up the day after you invoice an item. You will have a record of the deferred amount and the picked up amount.

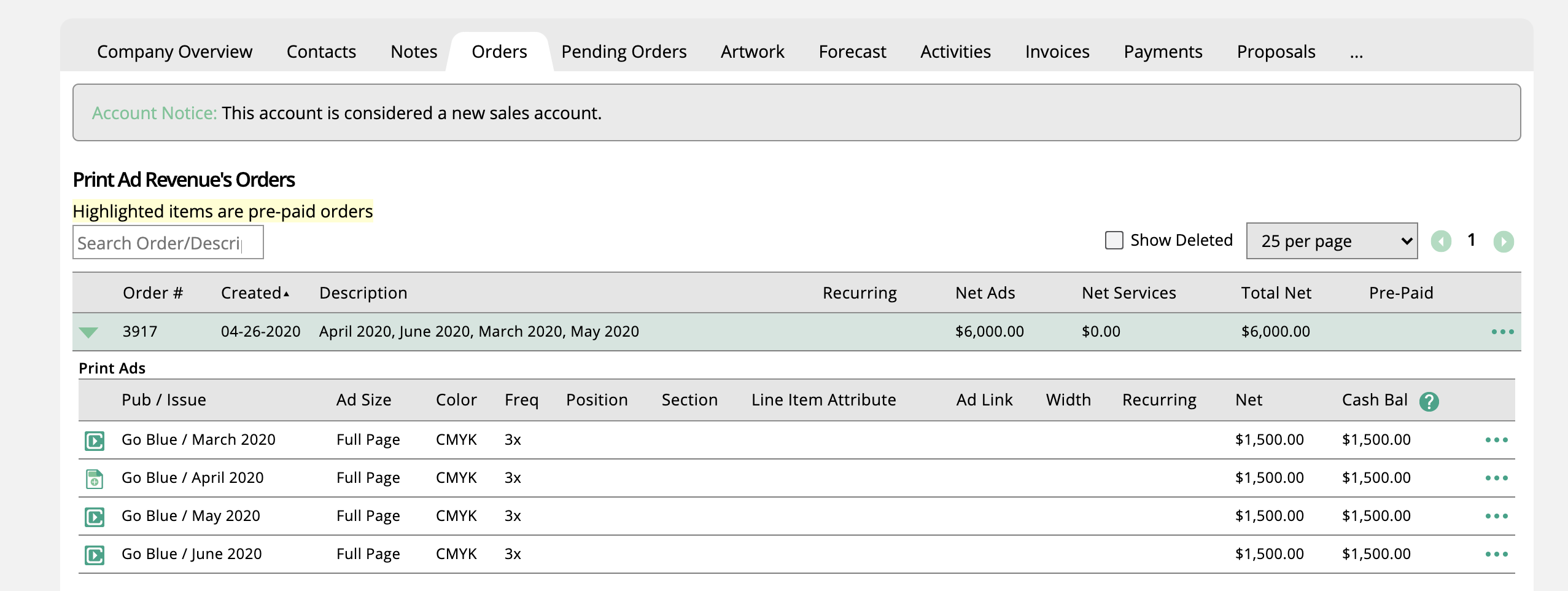

Below is the example order and the GL transactions. The order has a mix of past and future ad items. Any item in the past with an invoice will create an AR and a Revenue transaction. Future items will create an AR transaction and a deferred transaction. The Pick-up will happen once the issue is closed or the reporting date is in the past; this is based on your configuration.

The process of recognizing digital ad revenue can depend on your setup or how you enter your digital ad items. The process can work exactly as print if you create issues and don't leverage run dates. The process can work more dynamically if you decided to defer revenue based on run dates. Below we will go through both processes. If you want to recognize revenues based on run date, please contact support to enable this setting.

Digital advertisements are recognized based on the reporting date of the issue or the run end date. If an ad is on a past issue date or end date, the revenue can be recognized. If the ad is on a future issue or end date, the revenue must be deferred. You can add more control of recognizing revenue by closing your issues instead of relying on the reporting date.

To see the process of recognizing digital ad revenue, we will go through an order with ads. The order has an ad in two past issues and two future issues: 2 months ago, 1 month ago, next month, and 2 months.

The issue from 2 months ago is in the past and the ad has been invoiced. Because the item was in the past at the time of invoicing, the system will recognize the revenue immediately.

The issue from 1 month ago wasn't invoiced right away. The ad was on a past issue and not invoiced, so the item started as an un-billed receivable.

The item next month was invoiced so there is an increase in deferred revenue. so it will be recognized soon.

The invoice 2 months in the future wasn't invoiced so it is also deferred but won't be recognized for awhile.

If you go through the same process but use the run date options, the system will recognize the revenue at on the end date of the item.

The un-billed item account will balance to the revenue account the day after it is invoiced. You will have record of all the transactions for your history .

The next month item will be picked-up the day after you invoice an item. You will have a record of the deferred amount and the picked up amount.

The services you sell are recognized based on when they are delivered. A service that is delivered over a length of time can be recognized each month. No matter your services, you have to make sure the services work is marked done to either pick up the entire revenue or just a part of it.

The first thing you need to do before starting to sell and deliver your services is determine on the product level how you want to recognize revenue.

By default, the system assumes all service revenue should be picked up when the service item is considered done. But if the service you are providing can stretch across months, you should set up your service to use prorated revenue. Prorated serves will pick-up revenue at the end of each month between the service bill date and event dates.

For example, if you are providing a service for 3000 across 3 months, you can't pick up all the revenue at once. You should mark that service as prorated and set up the bill date to the start of the projects and the event date at the end. Once you reach the event date, all revenue can be recognized.

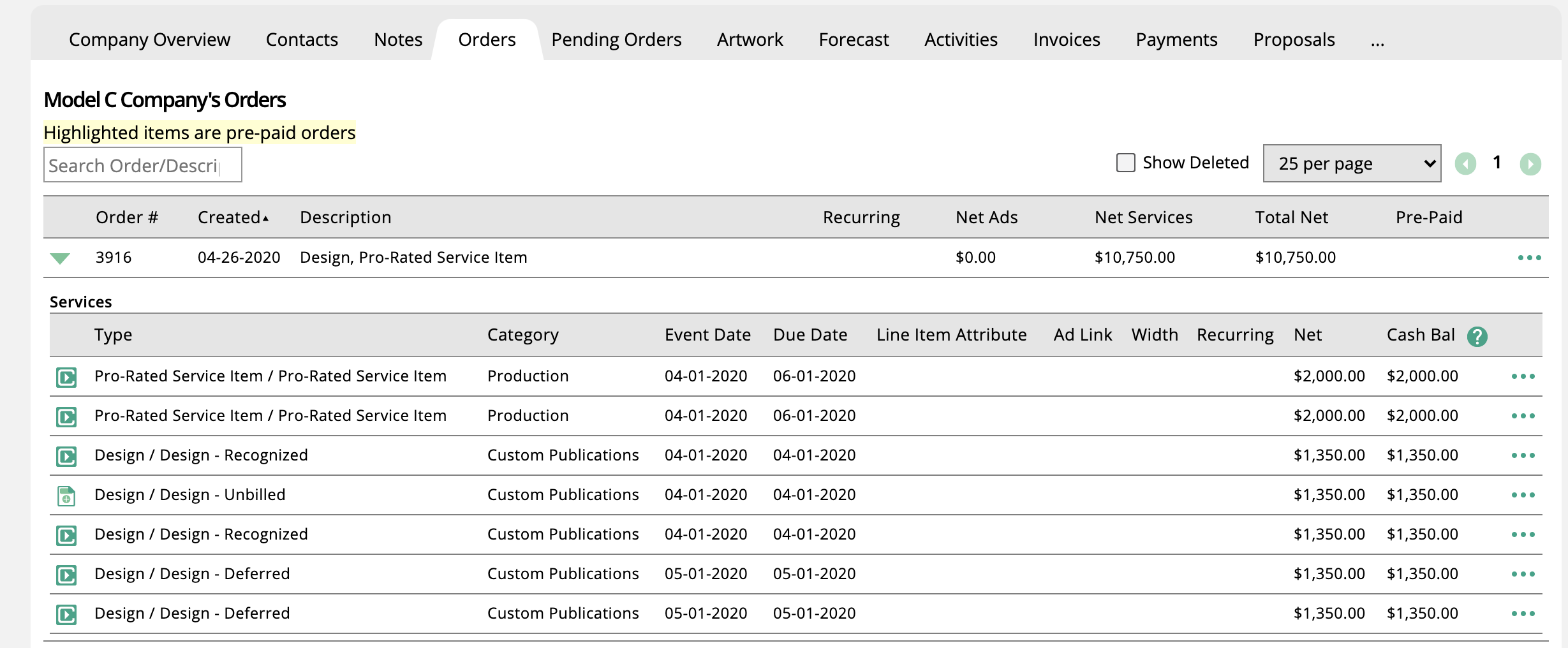

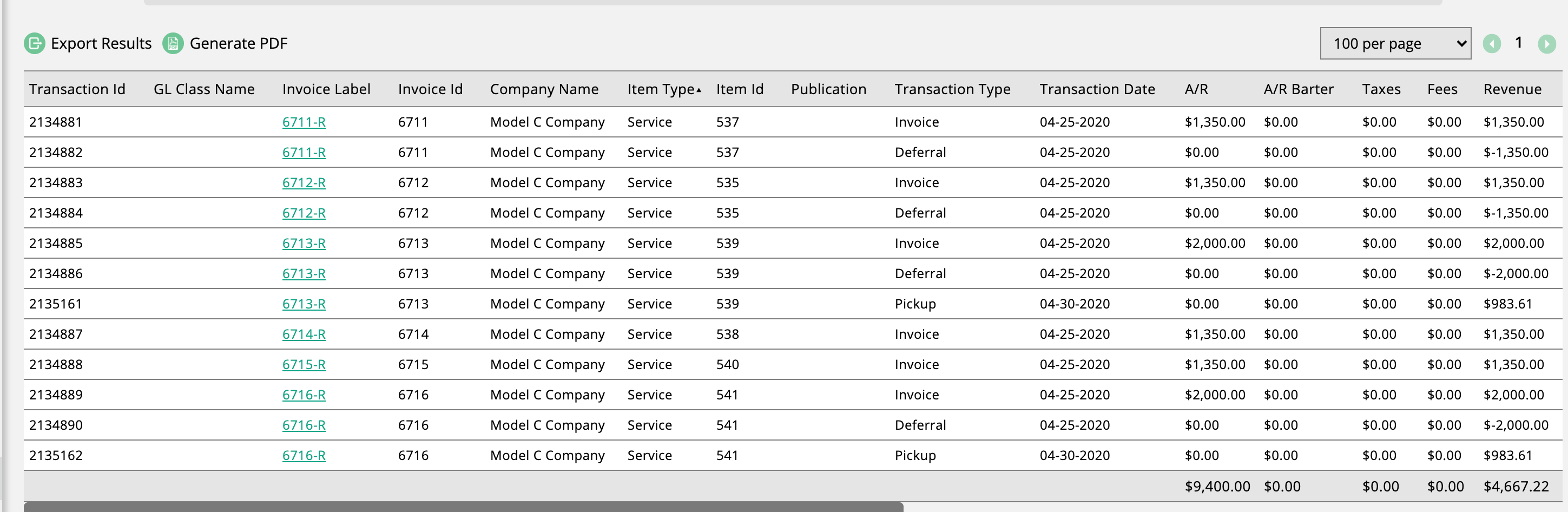

Below are some examples of how the revenue pick up system works. There is an order with a mix of services and dates and the GL transaction generated for it. The system generates the AR record and a Deferral record as soon as the order is invoiced. Once the ticket is marked done, the system will start the pick-up process. Only part of the revenue will be picked-up if the item is prorated.