Map your Products to Other Financial Systems

Map your products to items in another system, based on the accounts that you have set up, providing a smoother process for exporting your sales and order data. The product mapper affects the order and invoice exports. Besides mapping each product, you can also set up different mappings for booked or deferred accounts.

You will find the product mapping page under Settings > Billing > Product Mapping. You must have permission to access this page.

Updating the fields in the product mapper will update the CSV and QuickBooks exports for orders and invoices. Instead of exporting the default settings, the system will export your mapping.

Note

If you have QBO enabled, you can type in the name of your QBO product/services and the system will populate the fields. You must first set up the product and service in QBO before they will show up in Product Mapping.

You can map all product types. Each type has a hierarchy for what the system will export. There is also an option for either booked or deferred.

Ad Sales mapping will first check if the ad size has anything mapped. If nothing is mapped to the ad size, the system will check if the publication is mapped. If the pub isn’t mapped, the system will use the default settings. Example: I have an invoice for three line items. One line item has a mapped ad size, one a mapped publication, and the other isn’t mapped. The export file will have a different value for each item.

Service mapping will first check if the service has anything mapped. If nothing is mapped on the service, the system will check the service category. If nothing is mapped on the service category, the system will use the default settings. Example: I have an invoice with three line items. One line item has a mapped service item, one has a mapped category and one isn’t mapped. The export file will have a different value for each item.

You can also have different mappings based on booked or deferred items. The deferred bucket takes precedence overbooked. Don’t enter anything into a deferred date if you don’t defer and pick up revenue.

The deferred rules work differently for print, digital, and service items.

Print Deferred Rules:

Print ads are deferred if the ad is on an issue with a reporting date in the future. If you have enable issue closing on, the system will check the closed date instead of the reporting date.

Digital Deferred Rules:

Digital is deferred if the ad is on an issue with a reporting date in the future. If you have enable issue closing on, the system will check the closed date instead of the reporting date.

If the deferred digital setting is on, the system will check the run date on digital items to determine whether or not to defer the revenue. The system will compare the invoice date to the end date of a digital item. If the invoice date is in an earlier month then the end date of the digital ad, the system will defer the revenue. Also, if the run date spans multiple months, the item will be deferred.

Deferred Examples:

Invoice is dated 11/10

The run date is from 11/1 to 12/15

Digital ad is on an issue with a reporting/closed date of 12/15.

Service Deferred Rules:

If a service item is marked as prorated, the service will always be deferred.

If a service item is not marked as prorated, but the due date and event date span over 31 days and the event date is in the future, the service item will be deferred.

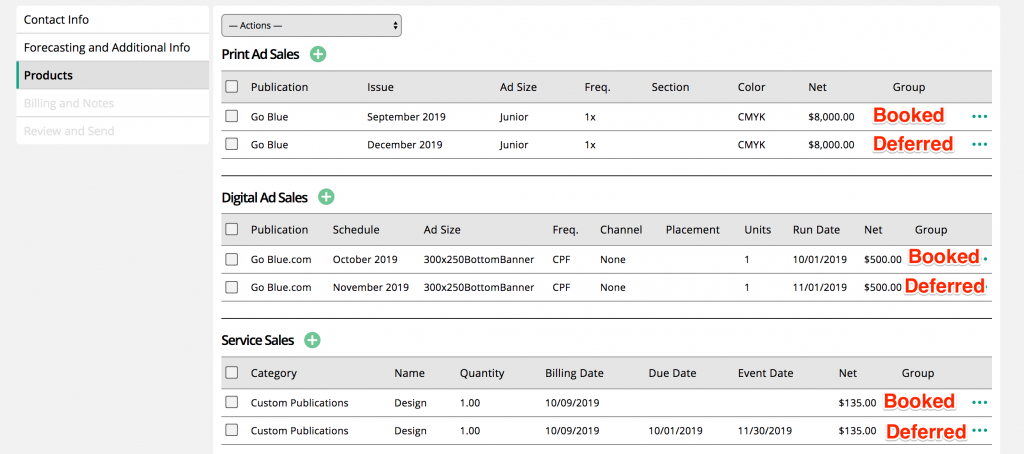

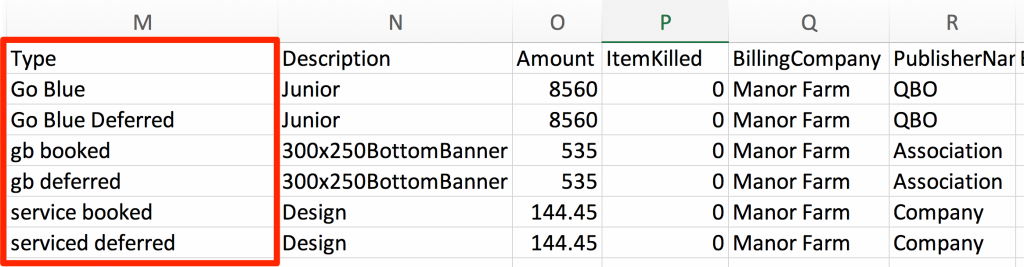

Below is an example of an order that will have a booked print, digital, and service item and a deferred print, digital, and service item. All of the items are invoiced in October.

The print ad is deferred because the item is on a December issue and is invoiced in October

The digital ad is deferred because the end date is in November.

The service item is deferred because the Event date is in November.

The exports will have different mappings for each item.