Avalara Integration

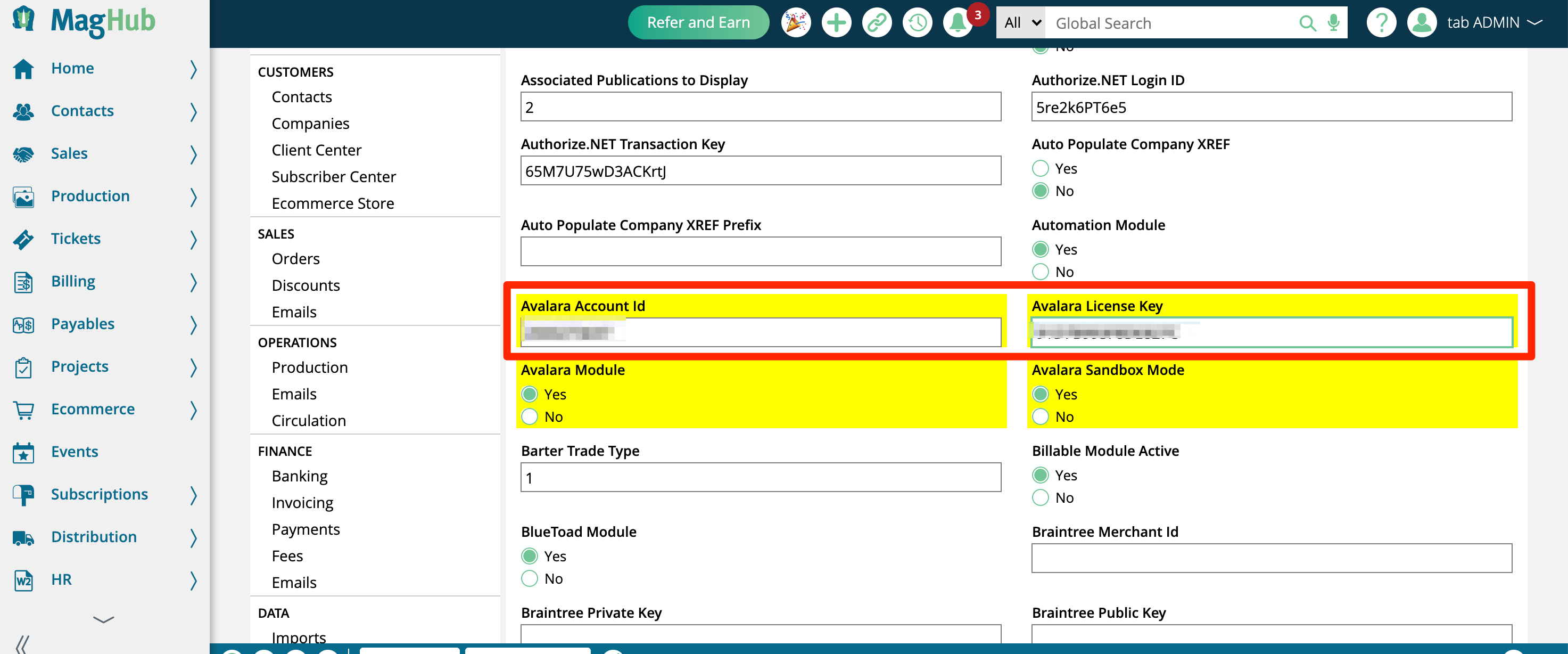

To use the integration you must have an active Avalara account. To connect the system you need to add your Avalara Account ID and License Key in your system.

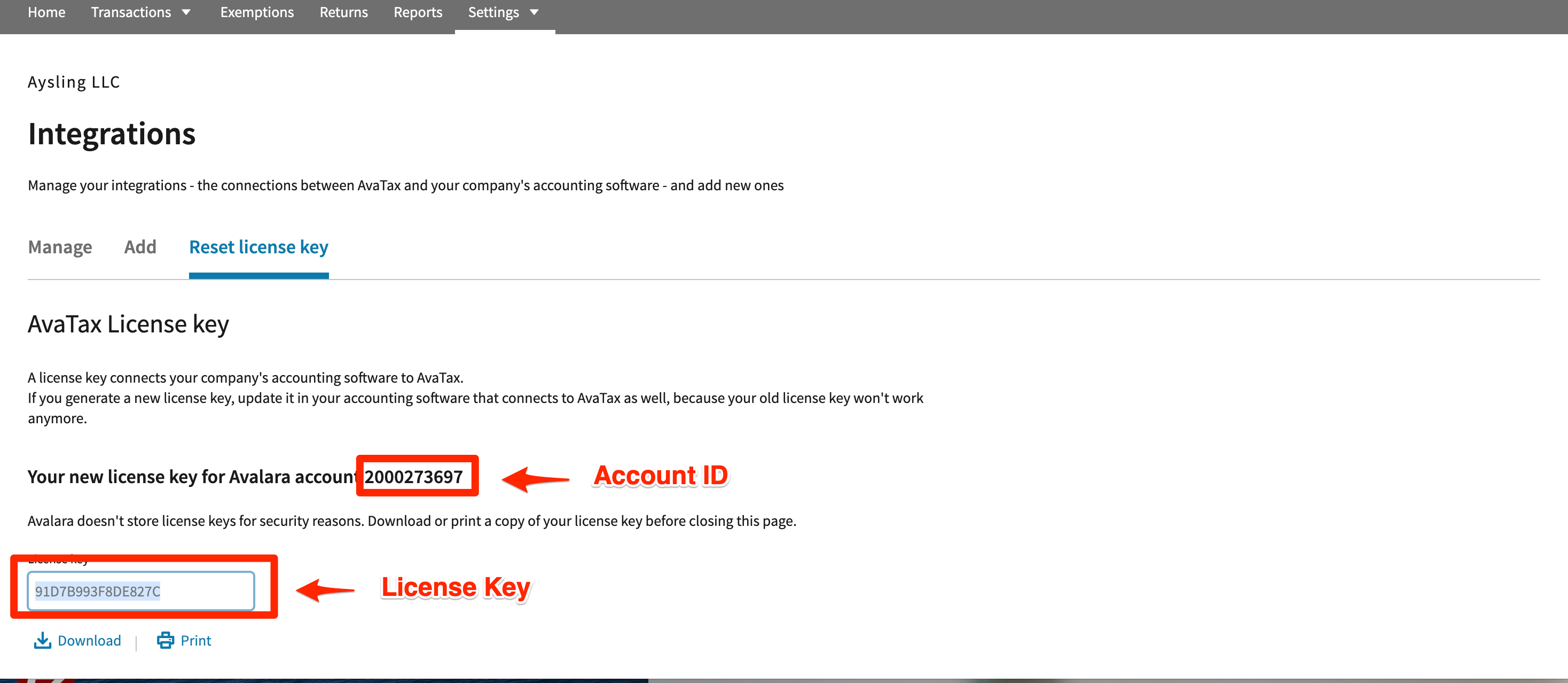

You can find your Avalara Account ID and License Key in Avalara by going to Settings > License and API Keys.

When you generate a new License Key, the page will show your Account ID and new License Key. Send this information to your support rep to enable the module in your site.

After the system is successfully connected, the system will start to calculate taxes based on the company address and default tax code of P000000. You will need to update your products to have tax codes if you want to push over more detailed information.

By default, if a product doesn't have a tax code in the system, the system will set that tax code as P0000000 in Avalara. You can update all your products in the system to match to a specific tax code or make tax exempt. You will see the item in Avalara as a sales invoice when your order is finance approved.

You can import or create your tax codes in Avalara under Settings > What you sell. Avalara has documentation on how to create your tax code.

You can enter tax codes on all of your products.

Print and Digital Ads: Go to Settings > Products > Rate Card & Ad Set Up and edit any of your available ad sizes. On the pop-up there is a tax exempt select and field to enter a tax code.

Digital Media Products: Got to Settings > Products and choose from Slots, Impressions, or Targeted Display Products. In the finance section you will see a tax exempt select option and a field to enter the tax code.

Service Products: Go to Settings > Products > Service Products and edit a service. There is a radio button to toggle whether the service should be tax exempt and a tax code field.

On service products, there are also Taxable Basis Percent and Taxable Cost Basis fields. The Taxable Basis Percent determines how much of the cost of the service item is taxable, and the Taxable Cost Basis field is automatically calculated by multiplying the price of the item by the taxable basis percentage. For example, if you have an item worth $250, and the Taxable Basis Percent is 50%, the Taxable Cost Basis would be a total of $125.

By default, the Taxable Basis Percent is set to 100%, so all the item is taxable. If the item is set to tax-exempt, the Taxable Basis Percent will automatically change to 0%.

The tax rates on orders and invoices will reflect the taxable basis percent of the item, and when adding or editing service items to orders, you will also see a Taxable Cost Basis field that shows how much of the item is taxable.

If the Taxable Basis Percent is not 100, then a tax code will be required to prevent potential tax calculation errors.

Note

The full amount of the service item will still be passed to Avalara, even if a Taxable Basis Percent is set. We recommend creating custom rules in Avalara for your tax codes, which work similarly to our Taxable Basis Percent field. If the product is connected to a tax code with a custom rule set on it, then when the item is brought into Avalara, it will display the taxable/non taxable amounts based on the Avalara custom rule for the product.

Note

Event Products do not currently support taxes with Avalara. You can enter taxes manually.

If you don't want to track taxes on a particular product, make sure to check the Tax Exempt Option. The system will set the rate to 0.

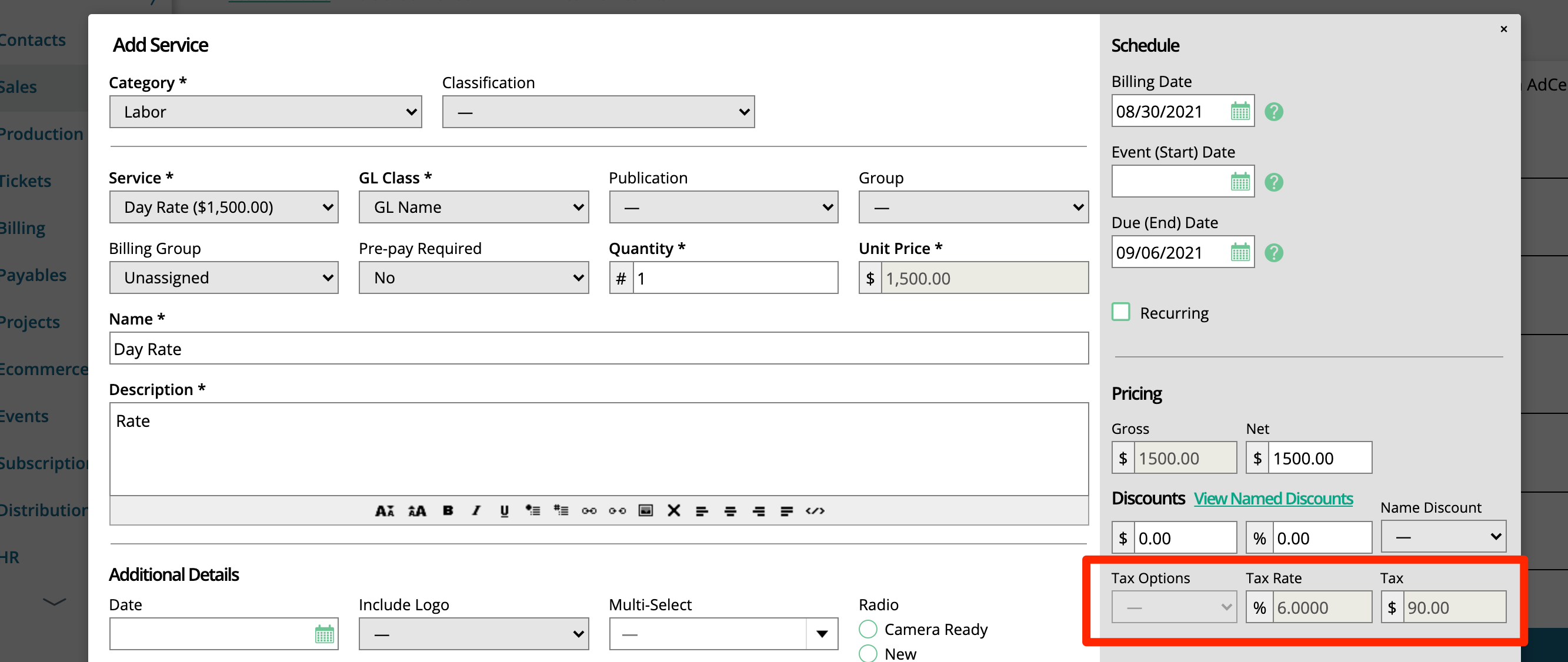

When Avalara is enabled, the tax field on line entry will not be editable. All tax rates will come directly from Avalara based on the product tax code and the address of the order company.

No matter the product, the tax amount will show up as a greyed out field when entering the line item.

If the product is marked as tax exempt, no value will show up in the rate and the user can't modify the rate.

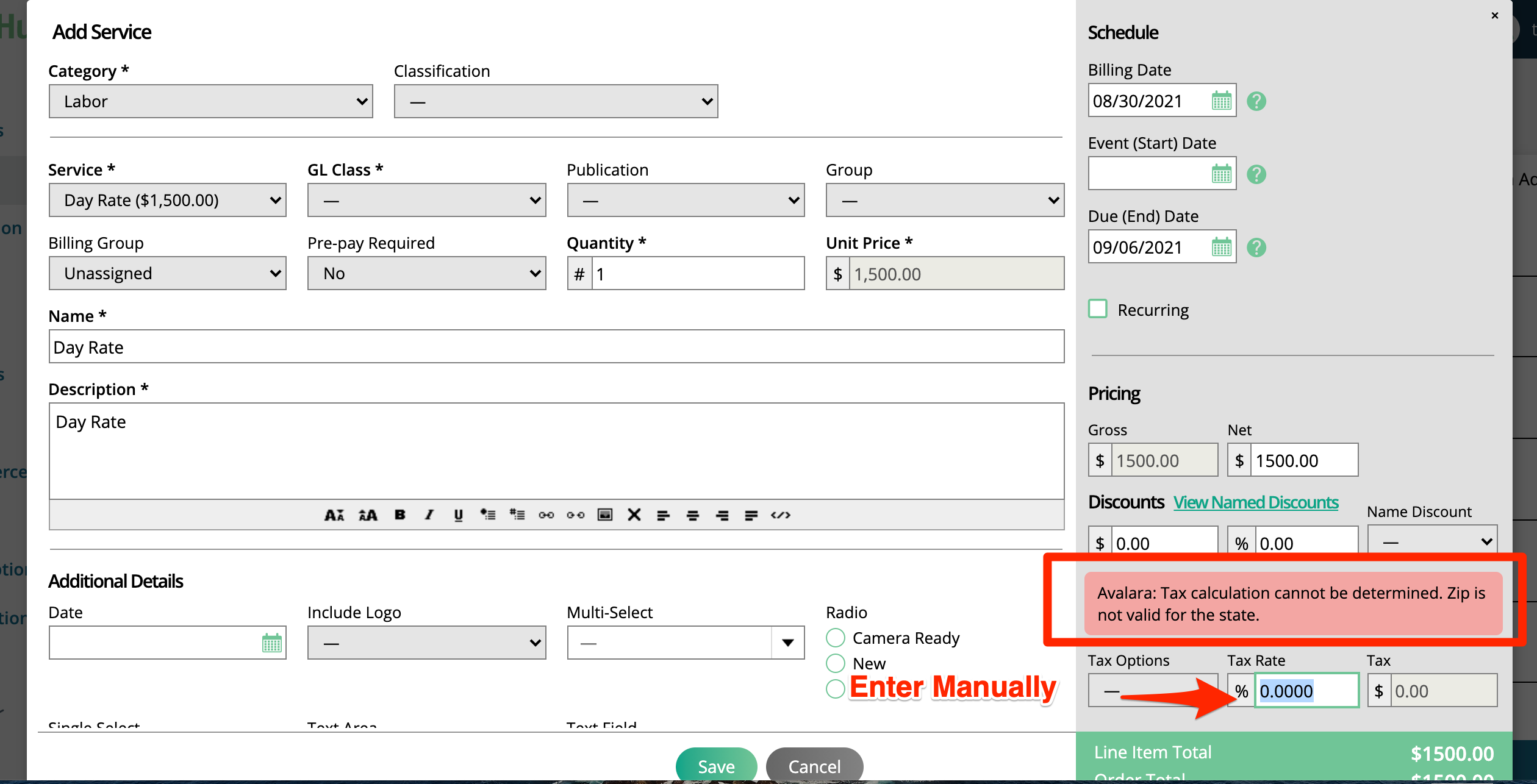

If there is a problem with the tax code or address, you will see an error above the tax amount with an explanation on how to fix the problem. A user can override the tax amount if there is a sync problem.

The system will push a Sales Invoice to your Avalara account when an invoice is paid in full . The system will calculate the tax rate again based on the rate at the time of payment. The Sales Invoice record in Avalara will show each item on the invoice and the tax payment.

When an item is first entered into the system as an order, we generate an estimated tax amount.

After an order is finance approved in the system , the system does another check of the tax rate. You can review your estimated liability in the system by checking amount of tax due. But no tax information is available in Avalara at this time.

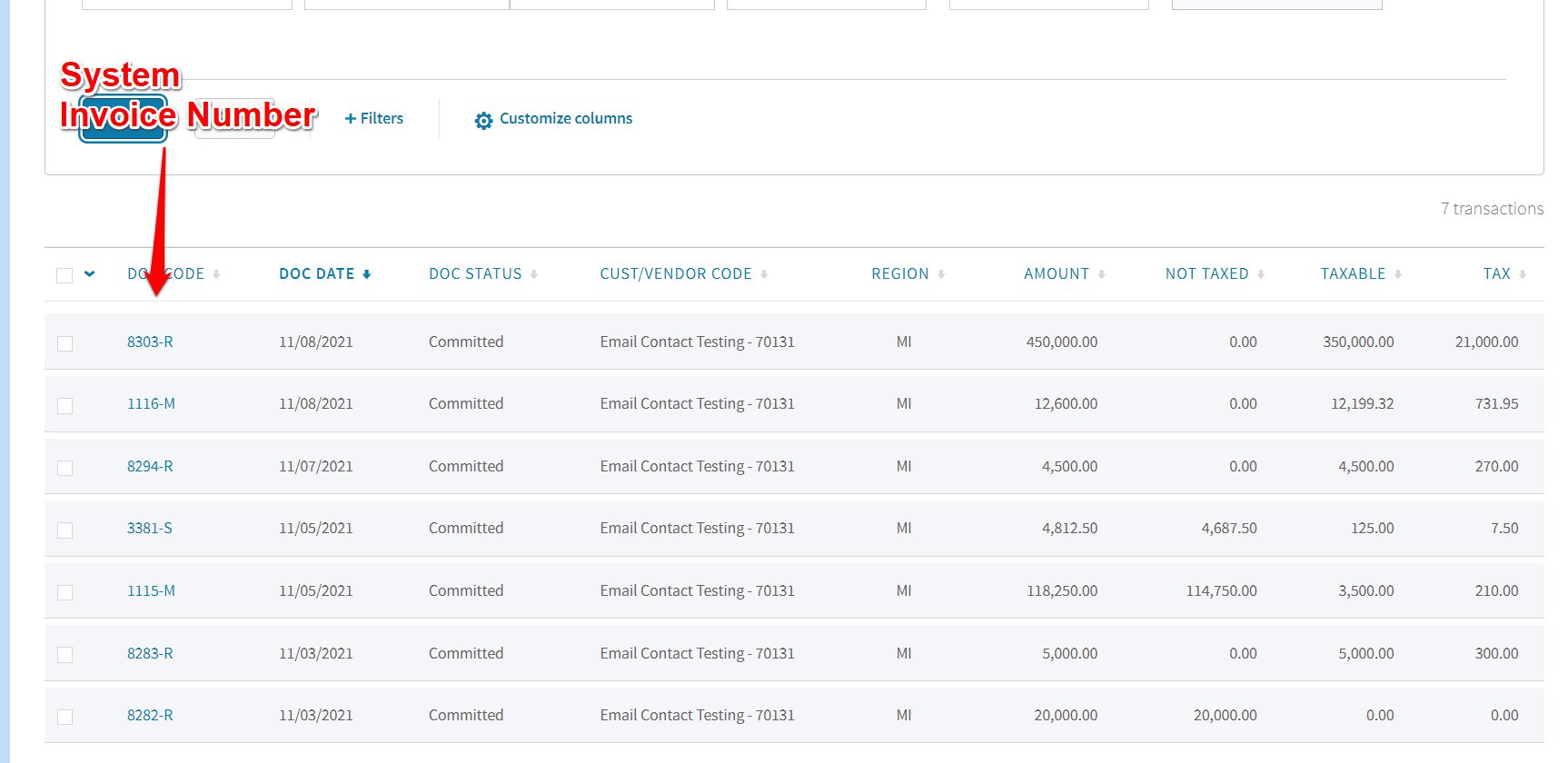

Once you have received payment for the invoice(s), is when data will flow to Avalara. The system will generate a new Sales Invoice in Avalara next for all fully paid invoices. We will include the Invoice Number in Avalara and a breakdown of all the line items on the invoice.

For installment invoices, the system will prorate the tax liability evenly across all line items associated with the invoice.

Credit Memo payments are not Taxable. For example, if you pay part of an invoice with a credit memo and the rest with cash, the system will only send the Cash payment to Avalara as taxable.

Any changes made to an item after it has been paid will NOT affect your Avalara account. Refunds and Adjustments must be made manually in both systems.

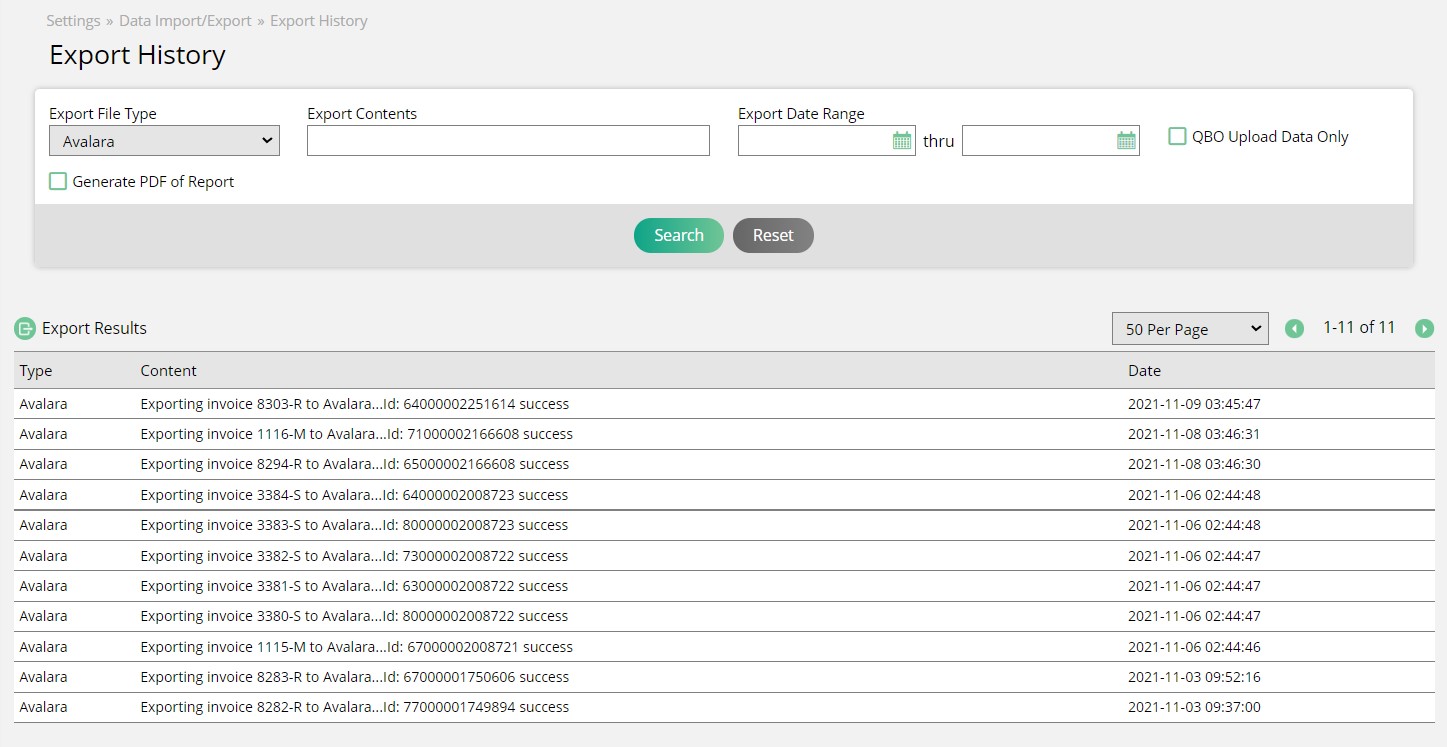

You can review all the exported items in the Export History under Settings > Data Import/Export > Export History and filter by Avalara.