Adding a Surcharge for Credit Card Payments

You can create surcharge fees that will be automatically applied to any order invoice paid by Credit Card. In order to take advantage of this feature, you need to have a payment processor enabled. Depending on how you set up your system configurations, the fee will either be a percent of the invoice’s total amount due, or it will be a fixed dollar amount. The surcharge works in all areas of the site where payments are processed, including manually applied payments within the system, the Client Center, and automated invoice payments.

Important

The fee will only be applied to order invoices. It is not applicable for subscription or ecommerce payments.

How to Set Up a Surcharge Fee

To set up a surcharge fee, navigate to Settings > System Configurations – Finance – Fees. There are three system configurations you will need to review.

Order Invoice Credit Card Surcharge Processing – This configuration determines whether or not to apply a surcharge fee, and if so what type of fee. This configuration works with the ‘Order Invoice Credit Card Surcharge Amount’ configuration. The number set in that field will determine either the percent or the fixed rate fee amount.

If you set the configuration to ‘No Surcharge’, no additional fee will be applied when paying by credit card.

Setting the configuration to ‘Percent of Total’, means the fee will be calculated based on the invoice’s total amount due, and the value entered in the ‘Order Invoice Credit Card Surcharge Amount’ field.

The ‘Fixed Amount’ surcharge type means that whatever value entered in the ‘Order Invoice Credit Card Surcharge Amount’ configuration will be applied as a dollar amount to the invoice.

Order Invoice Credit Card Surcharge Amount- The value entered in this field determines either the percent or the fixed rate fee amount, depending on which surcharge type you have chosen. For example, if you enter the value ‘10’ in this field, this would either apply a fee of 10% of the total invoice amount or apply a fee of $10 to the invoice. If you choose to not use surcharges, then this configuration will be ignored.

Surcharge processing language to display in Client Center - This configuration allows you to create a customized message for your customers to see in their Client Center, when a surcharge fee is being added. The message is intended to make it clear to the customer why a fee is being applied, and that the fee will not be applied if they use a different payment method.

The message will only show up in the Client Center if you have enabled surcharge fees, and the customer has selected Credit Card as their payment method. The fee will automatically be added to their total payment amount when paying by Credit Card; if they choose another payment method, the fee will not be added to the total.

Your surcharge configuration will show up as an invoice charge type, which you can view by navigating to Settings > Billing > Named Invoice Charges. The table will display the surcharge under the name ‘Credit Card Surcharge’, and have additional information including a description, method, frequency, and amount.

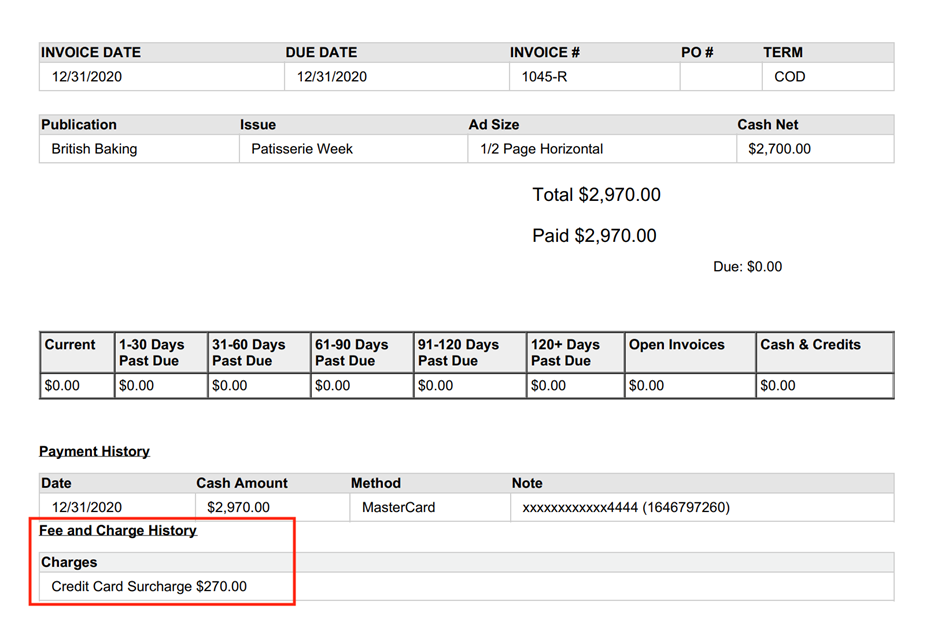

We also recommend reviewing your Invoice Templates. If you have the ‘Payment History’ element present on your invoice template, the invoice will show a ‘Fee and Charge History’, which includes credit card surcharges. We recommend adding this element, so that it is clear to your customers exactly what they paid for, and why the payment amount was greater than the original invoice total.

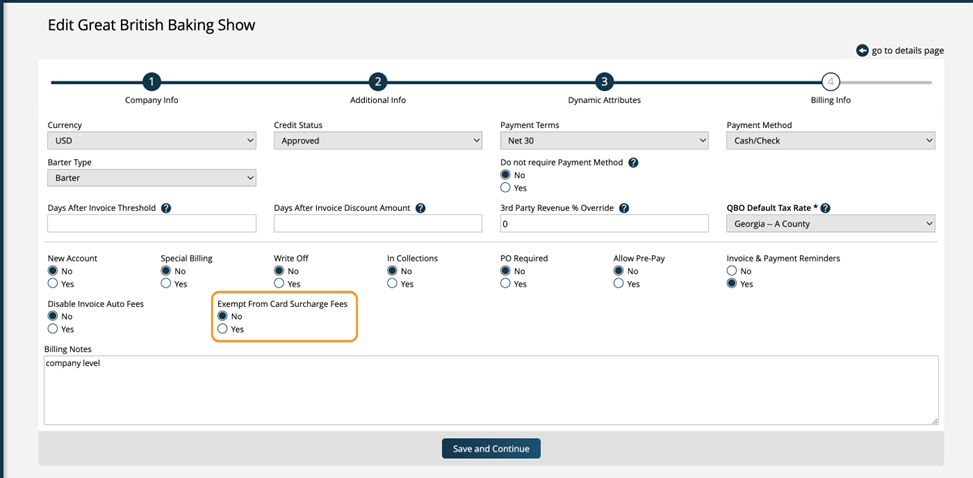

If needed, you can also disable surcharges for specific companies. This is helpful if you wish to have surcharges enabled in general in your system but wish to override the setting for specific accounts.

To change the surcharge requirement on a company level, you need the User Permission ‘Can Exempt Surcharge Fees’.

With permission, edit a company, and go to the ‘Billing Info’ edit step. Here, you’ll see a setting called ‘Exempt from Surcharge Fees’. By default, this is set to ‘No’. If you change it to ‘Yes’, then the company will never be charged surcharge fees, even if surcharges are enabled in your system otherwise and they are paying with a credit card.

Manually Processing a Payment

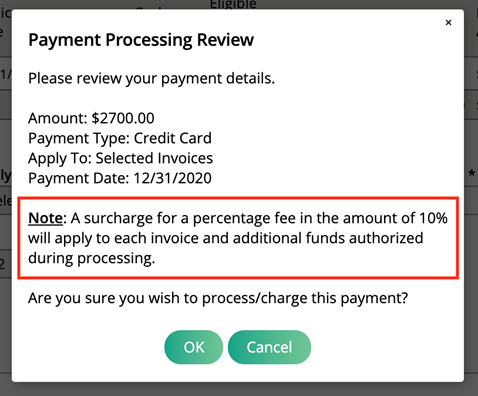

When users process payments using Credit Card as the payment method from the Record Payments page, they see a pop-up to confirm they want to process the payment. Now, if a credit card surcharge is configured in the system, the pop-up will also display information about the surcharge. Depending on how your system configurations are set up, the pop-up will either say the surcharge added will be a percentage fee or a fixed rate, along with the amount.

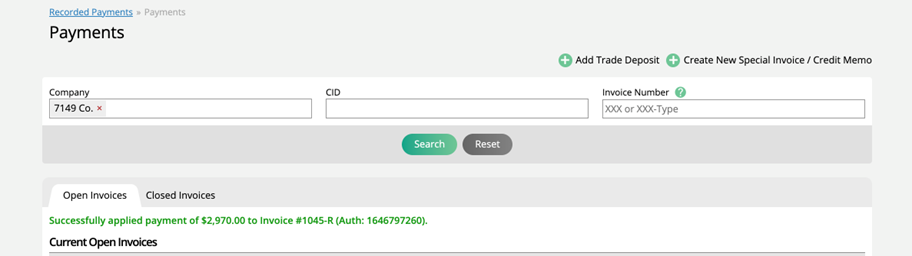

The payment that is processed will be for the total amount the user entered (typically the total amount of the invoice), plus the surcharge fee. Users will see the new total reflected in the successful payment message at the top of the Record Payments page.

For example, I processed a payment using a Credit Card in my site. The invoice was for a total of $2,700, with a percentage surcharge fee set at 10%. The payment that was actually processed was for a total of $2,970, which is $2,700 + the 10% fee of $270.

Paying an Invoice in the Client Center

If a customer pays an invoice in the Client Center using a Credit Card, they will see the surcharge message you set up in your system configurations, along with how much they will be paying, which is the total of the invoice, plus the fee. If they select a different payment method, the surcharge message and the extra fee amount will not be present. Customers will see the exact same messaging if they use the Pay Invoice link from an invoice payment email.

Automated Invoice Payments

If you have a Credit Card set on an order or invoice, and your system is set up to make automated payments, then the surcharge will be automatically applied to the invoice. If there is an ACH account set on an order or invoice, the automatic payment will not add the surcharge fee.

Tip

Only cards entered as Credit Cards will have surcharges applied. If a card's funding source is Debit, Prepaid, or Default if the Credit Card Default Funding Source system configuration is not set to 'Credit', no surcharges will be applied.

Updated 12/3/2024